While more and more legislation is introduced that penalizes all of us for doing things wrong on our tax returns, please remember that at its origin, tax collection in the U.S. is voluntary. In other words, the tax code is defined, we are given due dates, and the government asks us to voluntarily comply.

When you don’t, there are late filing penalties, underpayment penalties, fines, fees, interest and other imposed compliance incentives including audits. To help guide Congress and the Treasury Department, there are ongoing studies conducted to try to calculate the trends in non-compliance.

The Tax Gap

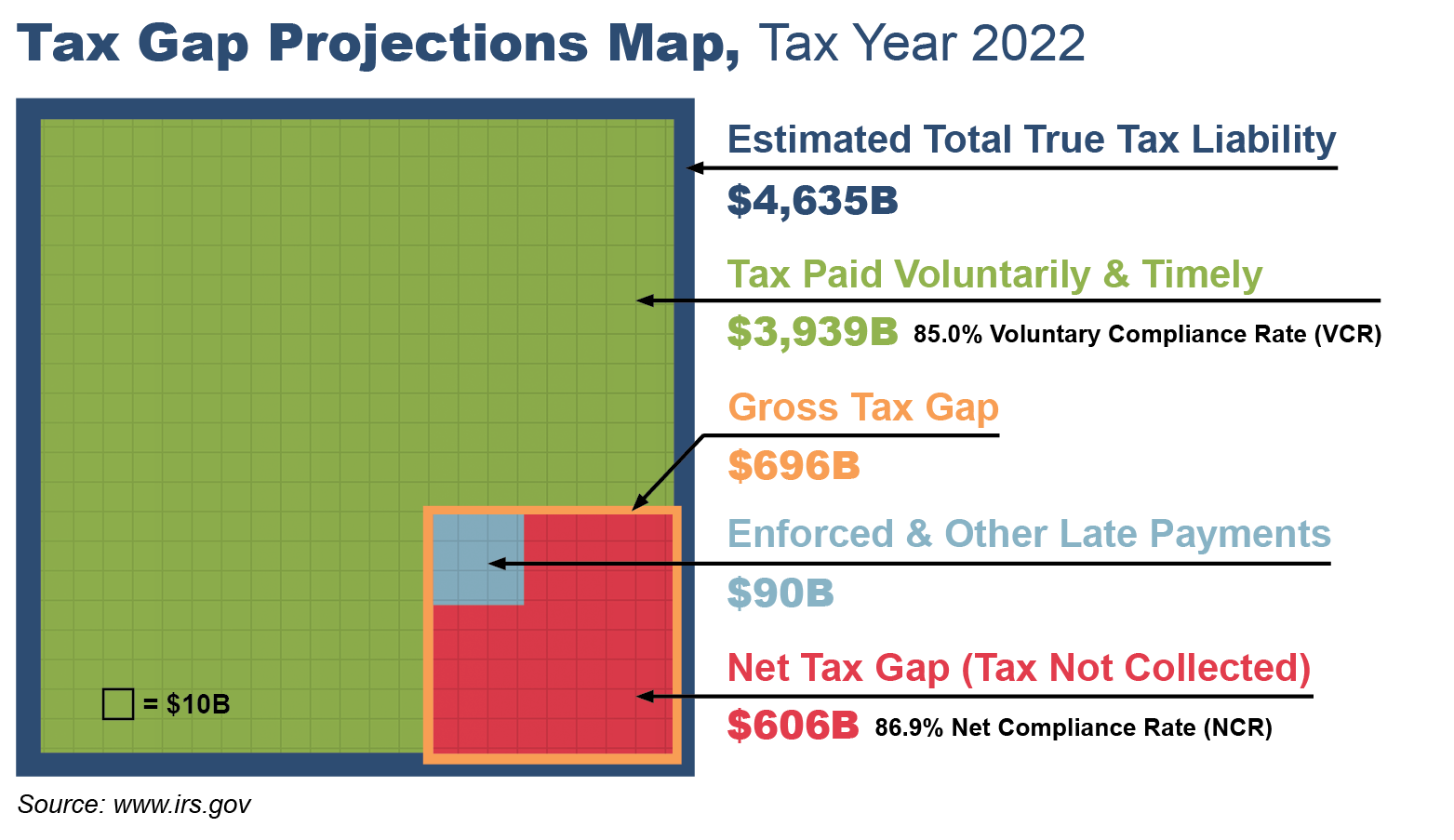

The result of this research is an estimate known as the Tax Gap. As you can imagine, calculating this Tax Gap is made very complicated due to the complex nature of the tax code. Here is the IRS’s most recent Tax Gap projection.

Key Observations

- Around 85% of the tax liability is actually paid, leaving underpayment of approximately 15%.

- Collection activity (audits, etc.) brings back approximately 1 to 2% of the underpayment.

- This leaves a projected tax gap of over ½ trillion dollars

- The gap consists of non-filing, under-reporting, and nonpayment, of which under-reporting tax liability is the largest culprit.

So What?

- The more that is under-reported, the more likely audits will bear fruit and increase over time.

- The less compliance, the more likely there will be an increase in pre-baked penalties. This can be seen in the recent trends to fine for late filing of W-2s and 1099s.

- Knowing this Tax Gap information suggests it makes sense to not be in the Net Tax Gap box as that is where compliance is focusing its attention.